investment guide

In this investment guide, we guide you through the fascinating world of gemstones and offer you valuable insights into how you can use them as part of your investment portfolio.

Table of contents

investment prospects

1. Market situation

2. Conventional asset protection

3. Carat Asset Protection

4. Value development of gemstones

5. Future prospects for gemstones

market comparison of real assets

6. Supplier comparison for gemstones

7. Gemstones vs. Precious Metals

Basic Knowledge of Gemstones

8. Evaluation criteria

9. Authentication

10. Ethics and Sustainability

11. Comparison of gemstone types

12. Our recommendation

market situation

The current global economic situation is characterized by unprecedented uncertainty and instability. Experts around the world are concerned about the escalation of geopolitical tensions, which could increase the risk of a large-scale war. In many regions, political conflicts are at a new peak, which is leading to additional volatility in the financial markets. At the same time, inflation is rising rapidly worldwide, reaching historic highs in many countries. This inflation is significantly reducing the purchasing power of citizens and putting many in economic distress.

The threat of hyperinflation, in which the currency becomes virtually worthless, is more real than ever. Economic historians warn that such conditions can significantly destabilize social and economic structures. Combined with the impact of the COVID-19 pandemic, which has already caused significant economic damage, hyperinflation could have devastating consequences.

Analysts are warning of an impending economic crisis that could destabilize financial markets worldwide. This crisis could be triggered by a combination of escalating geopolitical conflicts, economic misjudgments and natural resource shortages. The first signs of this development are already apparent: stock markets are volatile and traditional forms of investment such as bonds offer little protection from the financial storms that are looming on the horizon.

In addition to these challenges, many countries are facing significant budget deficits and rising debt levels. The impact of interest rate hikes could further strain credit markets and hamper economic recovery. Global supply chains, which were significantly disrupted during the pandemic, have also not yet fully recovered, adding to further economic uncertainty.

Given these turbulent economic conditions, wealth protection is becoming increasingly important. The next section focuses on how different strategies and types of investments, particularly gemstones, can help safeguard wealth and protect against the various risks.

Conventional Asset Protection

In today's uncertain global economic situation, protecting assets is crucial. Geopolitical tensions, inflation and economic crises threaten the financial stability and security of many investors. Asset protection aims to protect capital from losses and secure its value in the long term. This requires careful diversification and acquisition of real assets in order to minimize risks and ensure value stability.

Traditionally, investors rely on various strategies to protect their wealth, including:

- Diversification: The distribution of investments across different asset classes such as stocks, bonds and commodities in order to spread risk.

- Tangible assets: Investments in physical assets such as real estate that retain their value regardless of currency and market fluctuations.

- Liquidity: Ensuring that part of the portfolio is held in easily accessible and liquid assets in order to be able to respond quickly to market changes.

- Insurance: Use of insurance products to cover specific risks and avoid unexpected financial losses.

But history shows that these strategies alone are not enough. Stocks and bonds are nevertheless subject to considerable pressures. Real estate is often too immobile and difficult to liquidate quickly. Raw materials are generally too difficult to transport, liquidity loses value due to inflation, and insurance is often unreliable in crisis situations. Gold and silver are heavy and unwieldy in large quantities due to their weight and volume, which makes them much more difficult to store and transport.

The disadvantages of these asset classes can, however, be hedged through additional diversification in gemstones. Gemstones bring with them the advantages in an investment portfolio to minimize these disadvantages.

Carat Asset Protection

Diversification into gemstones is always a sensible addition to a balanced investment portfolio. Gemstones offer a variety of benefits that make them a valuable addition to traditional asset classes such as stocks, bonds and real estate. Due to their stability and independence from financial market volatility, gemstones offer protection against inflationary risks and economic uncertainties. Especially in times of increased economic instability and geopolitical tensions, investing in gemstones is not only sensible, but strongly recommended.

In extreme crisis situations, such as Black Swan events – unexpected, serious events such as wars or economic collapses – gemstones offer unparalleled protection. Here are the three main reasons:

Historical stability of value: Gemstones have proven to be extremely stable in value throughout history. During times of hyperinflation, economic collapses and even wars, gemstones have not only maintained their value but often increased in value. For example, during the hyperinflation in Germany in the 1920s and during World War II, gemstones retained their value and were a safe haven for wealth.

Compact Value Density: Another great advantage of gemstones is their high value density. A few small gemstones can represent millions in value, making them easily transportable and storable. This is especially important in times of crisis when mobility and the ability to quickly access assets are crucial. Unlike real estate or large amounts of precious metals, which are heavy and unwieldy, gemstones offer a practical and flexible way to secure and transport wealth.

Global recognition: Gemstones are recognized and valued worldwide as valuable assets. Their universal acceptance allows them to be liquidated in almost any country in the world, thus ensuring financial security. This is especially important in times of crisis, when the economic and political situation in a country becomes unstable and the liquidity of traditional assets may be limited.

At Carat Investments, we strongly believe in the importance of comprehensive diversification that includes not only gemstones but also other traditional investment instruments such as real estate, stocks and bonds. However, for optimal portfolio allocation, we strongly recommend considering gemstones as part of your investment strategy.

value development of gemstones

The historical performance of gemstones shows that they can be a valuable addition to traditional forms of investment. With their potential for appreciation and their ability to provide stability in economically turbulent times, gemstones are an interesting investment opportunity.

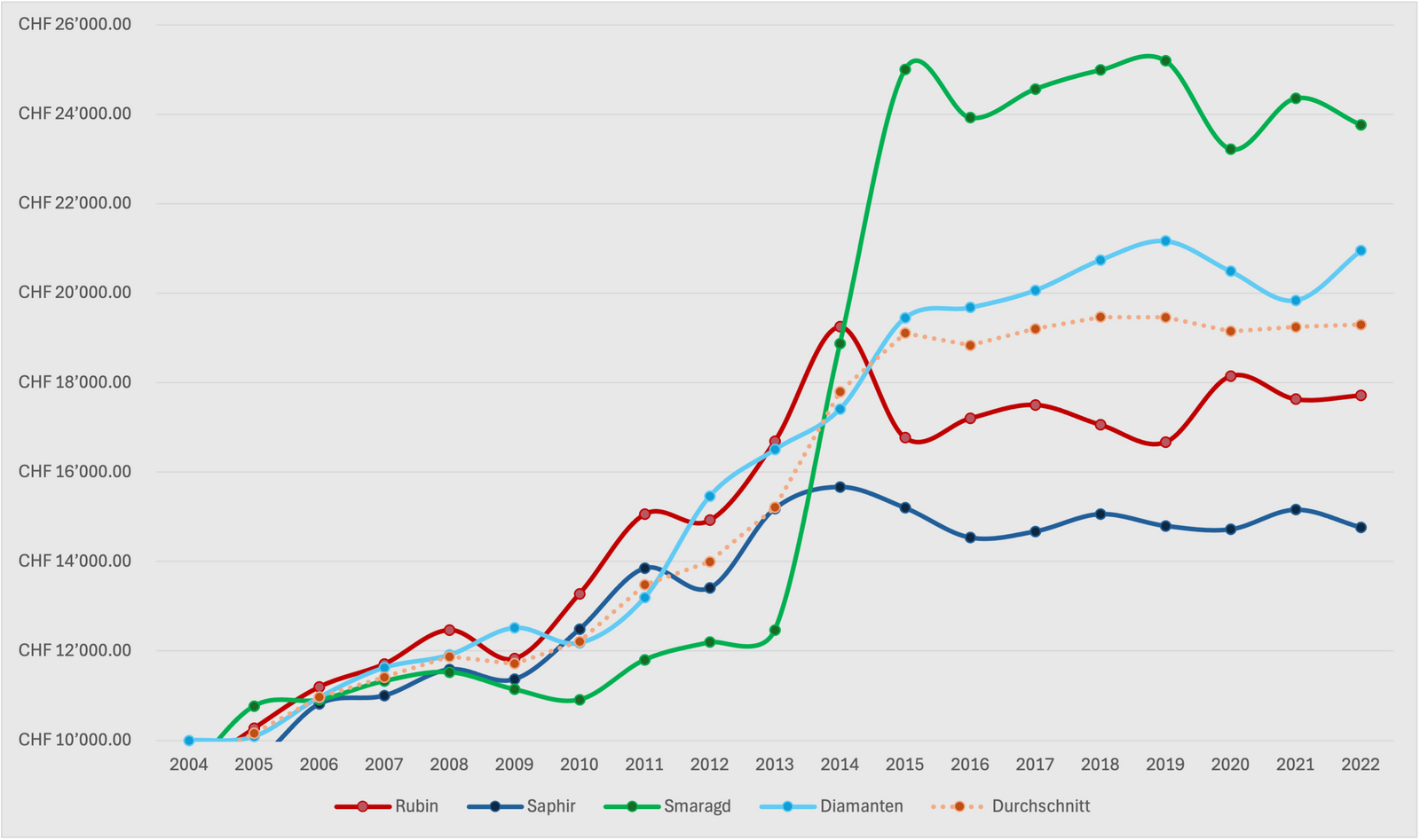

Absolut in CHF

Die absolute Wertentwicklung in CHF zeigt, wie sich der Wert einer Anfangsinvestition von CHF 10'000 in verschiedene Edelsteine im Laufe der Zeit entwickelt hat. Diese Kennzahlen geben den tatsächlichen Geldbetrag wieder, den die Investition zu verschiedenen Zeitpunkten wert ist, und ermöglicht es Investoren, die langfristige Performance und das Wachstumspotenzial der Anlage zu bewerten. Sie bietet einen klaren Überblick über die Wertsteigerung oder -minderung der Investition.

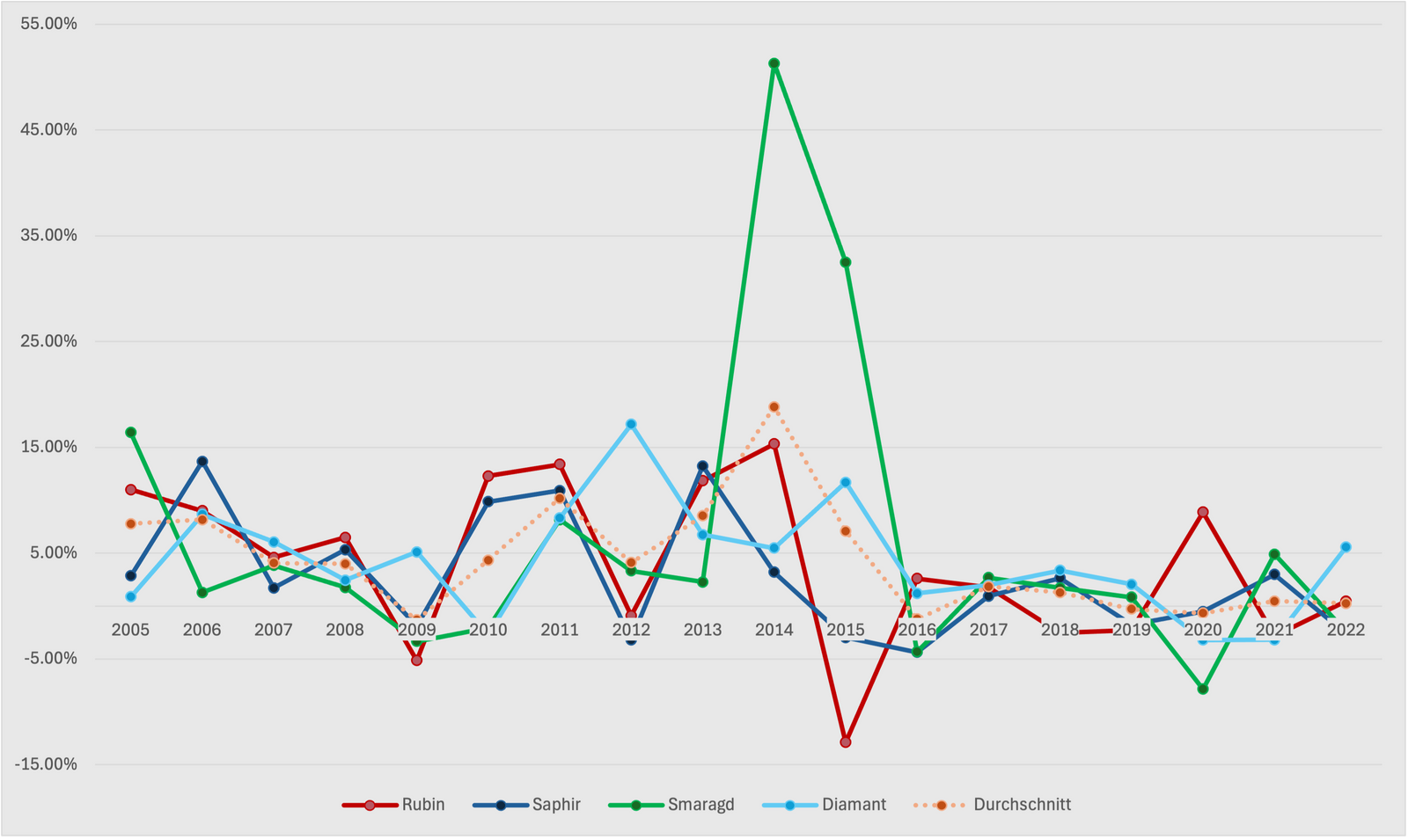

Relativ in %

Die relative Wertentwicklung in Prozent, auch als jährliche Rendite bezeichnet, gibt die prozentuale Veränderung des Wertes der Edelsteine von Jahr zu Jahr an. Diese Kennzahl hilft Investoren, die Volatilität und das Risiko der verschiedenen Edelsteinarten zu verstehen, indem sie die jährlichen Schwankungen und die Stabilität der Renditen aufzeigt. Sie ist ein nützliches Mass zur Bewertung der kurzfristigen Performance und zur Vergleichung der Effizienz verschiedener Investitionen.

graph annotations

emeralds

have experienced a remarkable increase in value from 2004 to 2014, culminating in a particularly strong increase in 2014. This shows that despite their volatility, emeralds can generate exceptional returns in certain years.

"

exhibit the highest volatility, with extreme fluctuations in annual returns. Years such as 2014 (51.30%) and 2015 (32.51%) contrast with years with negative returns, such as 2019 (-7.84%).

diamonds

show a continuous and stable increase in value over the period under consideration. This stability makes them a conservative investment option compared to other gemstones.

"

show a more stable annual return compared to the other gemstones. Their fluctuations are less extreme, which makes them a lower-risk investment.

sapphires and rubies

show a moderate increase in value, with less dramatic fluctuations than emeralds, but also not as stable as diamonds. Rubies showed significant increases in value in 2011 and 2014.

"

have years with positive and negative returns, with fluctuations being somewhat more pronounced for rubies than for sapphires.

Average

shows a generally positive development over the period, indicating that gemstones as an asset class are experiencing overall increases in value.

"

All gemstones have recorded negative returns in certain years, demonstrating that despite long-term increases in value, losses are possible on short-term investments.

future prospects for gemstones

Gemstones have played an important role as an investment for centuries. Their rarity, beauty and lasting value make them a particularly attractive investment opportunity. The future prospects for gemstones are positive, supported by economic, technological and social factors.

With the rise of the middle class in emerging markets such as China and India, demand for luxury goods, including gemstones, is increasing. This growing affluent population is increasingly investing in assets that retain their value and are aesthetically pleasing, which is expected to boost the global gemstone market and drive prices further higher.

Gemstones are increasingly viewed as safe haven assets, particularly in times of economic uncertainty and political instability. Their independence from financial market volatility and inflation makes them an attractive investment option. Investors looking for diversification opportunities outside of traditional markets find gemstones a solid alternative. In times of high inflation and currency devaluation, gemstones offer a stable investment. Their ability to maintain purchasing power makes them particularly attractive for investors who want to protect their wealth against the erosion of inflation. Historically, gemstones have maintained or even increased their value in times of economic turbulence.

The global diamond market was worth $94.19 billion in 2023 and is expected to grow to $138.66 billion in 2032, according to fortunebusinessinsights.com, representing an annual growth rate of 4.5%. This positive forecast highlights the potential of diamonds as a stable investment.

Another important factor is Russia. Currently, stocks of natural diamonds of jewelry standard, especially flawless gemstones, are running low worldwide. Compared to the time before the Ukraine crisis, only 25% of the supply at that time is available. This shortage of supply could lead to further price increases and have a positive effect on the value of diamonds.

Analysts predict that prices for high-quality gemstones will continue to rise due to increasing demand and limited supply. The gemstone industry could benefit from the growing middle class and increasing interest in alternative investments.

The future prospects for gemstones are promising and offer investors a stable and attractive opportunity to diversify their portfolio.

Marktvergleich von Real Assets

Die Investition in portable reale Vermögenswerte wie Edelmetalle und Edelsteine hat in den letzten Jahren erheblich an Bedeutung gewonnen. Im Gegensatz zu traditionellen Finanzinstrumenten bieten reale Vermögenswerte einen physischen Wert, der weniger anfällig für Marktschwankungen ist. In diesem Abschnitt vergleichen wir verschiedene Anbieter von Edelsteinen und stellen Edelsteine Edelmetallen wie Gold und Silber gegenüber.

supplier comparison for gemstones

Carat Investments offers several unique advantages that set us apart from other providers. Some of them are listed below:

price leadership

Our exclusive distribution system, in place since 1744, allows us to offer gemstones at wholesale prices while our competitors sell at retail prices. This price advantage provides our customers with significant savings, as they pay on average around 20% less for the same high-quality gemstones. This cost efficiency is achieved through our deep-rooted network and centuries of experience in the gemstone trade, which allows us to maintain direct relationships with the best mines and suppliers worldwide.

Exclusive gemstones

Our centuries-old tradition and our extensive network give us access to particularly rare and valuable gemstones. These exclusive stones that we can offer are often not available from other suppliers.

bonded warehouse

Another significant advantage is storage in a duty-free depot for goods valued at CHF 100,000 or more, which we can offer thanks to our partner Helveticor from the Planzer Group. This solution means that no Swiss value added tax (VAT) of 8.1% is charged on the purchase price. Customers therefore save 8.1% on the purchase price and even up to 20% compared to foreign providers in Germany (19% VAT) and Austria (20% VAT).

Experienced advice

Our specialists have extensive experience in the areas of asset management, private banking and risk management. This expertise enables us to guarantee advice and support at the highest level. We ensure that our clients are well informed and supported in making well-founded investment decisions. This advice is based on a deep understanding of the gemstone market and the individual needs of our clients.

When compared with foreign providers, there are further advantages:

tax advantages

In Switzerland, there is no capital gains tax on private capital gains from movable private assets such as gemstones, provided they are held for more than one year. This makes Switzerland particularly attractive for long-term investments. Switzerland's stable legal and political framework offers additional security and trust for investors.

VAT benefits

The Swiss VAT is only 8.1%, which represents a significant saving compared to the 19% in Germany and 20% in Austria if the customer decides to purchase the gemstones in Switzerland and store them in a bank safe deposit box in Switzerland. Furthermore, by using the above-mentioned duty-free warehouse, a complete saving on VAT can be achieved. This represents a unique opportunity to further optimize the cost structure and maximize the net value of the investment.

We pride ourselves on offering our customers the best deals on the market. At the same time, we encourage you to do your own research and compare different providers. Transparency and trust are important to us and we are convinced that by making a comprehensive comparison you will find that Carat Investments is the optimal choice for your gemstone investment. Compare our offers, the quality of our gemstones and the service we offer. We are confident that you will see the added value that Carat Investments offers you.

Gemstones vs. Precious Metals

When it comes to real assets with quick liquidation options, we believe in an optimal mix between gemstones and gold bars. In the following section, we discuss the differences between gemstones and precious metals.

Value density, transport and storage

Gemstones are characterized by an exceptionally high value density. A small gemstone can have the same value as several kilograms of gold, which makes them particularly practical for transport and storage. The compact size and low weight of gemstones enable simple and discreet storage, which requires significantly less space compared to the more spatially intensive requirements of precious metals.

price difference between stock exchange and physical

A key difference between precious stones and precious metals is the price difference between the stock market price and the physical price. Precious metals such as silver, platinum and palladium can be significantly more expensive in physical trading than their stock market price. Silver is 40-50% more expensive in physical trading than its stock market value, platinum 25-35% and palladium 30-35%. Coins made of gold or silver also have a value difference of around 15%.

While gold bars and gemstones both have a small price difference, gold bars tend to be 2-7.5% more expensive than their market value. Gemstones, on the other hand, have an even smaller price difference at 1-5%, making them an attractive option for investors who value low transaction costs. This lower additional cost of gemstones increases their appeal compared to precious metals, especially for those who are looking for cost efficiency.

We recommend a balanced investment strategy that includes both gemstones and gold bars. This combination uses the advantages of both types of investment and offers an optimal balance between value stability, liquidity and a small price difference in physical trading. A diversified investment strategy with a mix of gemstones and gold bars protects your assets while offering flexibility and security in uncertain times.

Basiswissen Edelsteine

Edelsteine haben seit Jahrhunderten eine faszinierende Rolle in der Geschichte der Menschheit gespielt, sowohl als Schmuckstücke als auch als Wertanlagen. Um fundierte Entscheidungen bei der Investition in Edelsteine zu treffen, ist es wichtig, ein grundlegendes Verständnis für die Eigenschaften und Bewertungskriterien dieser kostbaren Steine zu haben.

evaluation criteria

Gemstones are graded according to four basic criteria known as the 4Cs: carat weight, clarity, color and cut. These criteria apply to diamonds as well as colored gemstones such as rubies, sapphires and emeralds.

Carat

Das Karatgewicht misst die Masse eines Edelsteins. Ein Karat entspricht 0,2 Gramm. Grössere Edelsteine sind seltener und daher wertvoller.

Diamanten

Das Karatgewicht bei Diamanten ist eine der wichtigsten Bewertungsgrössen. Der Preis eines Diamanten steigt exponentiell mit dem Karatgewicht, da größere Diamanten seltener sind. Ein Diamant von 2 Karat ist nicht nur doppelt so teuer wie ein 1-Karat-Diamant, sondern oft ein grösseres Mehrfach teurer.

Farbedelsteine

Das Karatgewicht ist auch bei Farbedelsteinen ein wichtiger Wertfaktor. Im Gegensatz zu Diamanten variieren die Preiserhöhungen je nach Farbe und Qualität des Steins. Grössere Farbedelsteine sind ebenfalls seltener und wertvoller, wobei intensive Farben und Klarheit den Preis in einer Balance verstärkt wezusätzlich beeinflussen.

Clarity

Reinheit beschreibt die Anzahl, Grösse, Art und Position von inneren Einschlüssen und äusseren Merkmalen. Diese beeinflussen die Transparenz und Brillanz eines Edelsteins.

Diamant

Die GIA-Skala für Diamanten reicht von "Flawless" (FL) bis "Included" (I3). Einschlüsse und äußere Merkmale können die Lichtreflexion und Brillanz des Diamanten beeinträchtigen. Bei der höchsten Reinheitsstufe "Flawless" sind keine Einschlüsse sichtbar, selbst unter 10-facher Vergrößerung.

Farbedelsteine

Farbedelsteine haben oft mehr Einschlüsse als Diamanten. Die Akzeptanz dieser Einschlüsse variiert je nach Steinart. Zum Beispiel sind Einschlüsse in Smaragden eher akzeptiert als in Rubinen oder Saphiren. Einschlüsse können manchmal auch die Farbintensität und den Charakter des Steins beeinflussen.

Color

Die Farbe eines Edelsteins umfasst Farbton, Sättigung und Helligkeit. Ideale Farben variieren je nach Edelstein.

Diamanten

Bei Diamanten beschreibt die Farbbewertung, wie farblos ein Diamant ist. Die GIA-Skala reicht von D (absolut farblos) bis Z (deutliche Farbspuren). Farblose Diamanten (D-F) sind am wertvollsten.

Farbedelsteine

Farbedelsteine werden nach ihrer Farbe bewertet, die die Kombination aus Farbton, Sättigung und Helligkeit umfasst. Für Rubine sind tiefrote Farben ideal, während für Saphire ein intensives Blau bevorzugt wird. Smaragde sind für ihr leuchtendes Grün bekannt.

Cut

Der Schliff eines Edelsteins beeinflusst seine Fähigkeit, Licht zu reflektieren und seine Brillanz zur Geltung zu bringen.

Diamanten

Bei Diamanten ist der Schliff entscheidend für die Lichtreflexion und Brillanz. Die GIA-Skala reicht von "Excellent" bis "Poor". Ein gut geschliffener Diamant maximiert die Lichtreflexion.

Farbedelsteine

Der Schliff eines Farbedelsteins maximiert die Farbintensität und Brillanz. Die Qualität des Schliffs beeinflusst, wie gut der Stein Licht reflektiert und wie lebendig seine Farbe erscheint. Der Schliff kann auch die Form des Steins betonen.

Auf Basis dieser 4 Cs erstellen wir ein international anerkanntes Wertgutachten für jeden Edelstein. Ein detailliertes Wertgutachten bietet Ihnen Klarheit über den tatsächlichen Wert Ihres Edelsteins, was Transparenz und Sicherheit schafft. Dies ist besonders wichtig beim Kauf, Verkauf oder bei der Vererbung des Edelsteins, da es Vertrauen und Sicherheit vermittelt. Ein solches Gutachten ermöglicht eine präzise Marktwertbestimmung, sodass Sie den aktuellen Marktwert Ihres Edelsteins genau kennen. Dies ist entscheidend, um sicherzustellen, dass Sie einen fairen Preis erhalten oder zahlen, unabhängig davon, ob Sie den Edelstein als Investition halten oder weiterverkaufen möchten. Des Weiteren ist ein offizielles Wertgutachten oft notwendig, um den Edelstein zu versichern. Es stellt sicher, dass Sie im Schadensfall den richtigen Wert erstattet bekommen. Zudem bestätigt unser Gutachten nicht nur den Wert, sondern auch die Qualität des Edelsteins, basierend auf den strengen Kriterien der 4 Cs. Dies ist ein unverzichtbarer Nachweis, der den Edelstein gegenüber potenziellen Käufern oder Erben legitimiert und seine Echtheit und Qualität belegt.

authentication

In addition to determining the value, authenticating your gemstones is also crucial to ensure their authenticity and quality. Reliable authentication gives you the assurance that you are getting exactly what you are investing in. It protects your investment from counterfeits and inferior products and ensures that your gemstones retain their true value.

Our diamonds are certified by the Gemological Institute of America (GIA). Diamonds 0.15 carats and above receive a unique GIA report number that is laser engraved onto the stone. This engraving is visible with a magnifying glass and allows easy identification of your diamond, allowing you to check its compliance with the GIA certificate. GIA certificates provide a detailed analysis of the 4Cs (carat, clarity, color, cut) and give a comprehensive evaluation of the diamond. GIA certificates are recognized worldwide and are considered the standard in diamond grading.

Our colored gemstones such as rubies, emeralds and sapphires are certified by the Swiss Gemmological Institute (SSEF). These certificates confirm the authenticity and quality of the colored gemstones and offer an impartial and precise evaluation. SSEF offers special analyses for the origin and possible treatments of the colored gemstones, which should be taken into account especially for historical or exceptional pieces. SSEF is highly regarded, especially in Europe, and offers additional security through its strict evaluation standards.

Certification by reputable institutes such as GIA and SSEF is an indispensable tool for any gemstone investor. It provides an impartial evaluation based on strict scientific criteria. These independent evaluations ensure that the gemstones meet the highest quality standards.

A GIA or SSEF certificate creates a foundation of trust that is essential for buyers and sellers alike. It provides transparency and security in the gemstone trade and guarantees that the beauty and uniqueness of each stone is fully captured and appreciated. Rely on the expertise of GIA and SSEF to ensure that your gemstone investment is of the highest quality and authenticity. Certified gemstones tend to have a higher appreciation in the market as they enjoy greater trust among buyers due to the independent confirmation of quality and authenticity.

Ethics and Sustainability

In the world of investment diamonds and colored gemstones, the importance of ethical sourcing and sustainable practices is increasingly coming to the fore. Our commitment to ethical standards and sustainability is deeply rooted in our corporate philosophy. We ensure that our gemstones are conflict-free and place great emphasis on transparency and responsibility in our trading process.

Our recommendation

To ensure maximum value and the best long-term performance of your investment, we recommend focusing on diamonds with "Internally Flawless" (IF) clarity and "D" color, as well as carefully selected rubies, emeralds and sapphires. These gemstones represent the pinnacle of quality and offer exceptional beauty and lasting value.

For diamonds:

Diamonds with "Internally Flawless" clarity and "D" color are very rare and highly sought after. These unique properties ensure that the diamond is free of internal and external inclusions, even under 10x magnification, resulting in unmatched brilliance and light reflection. Such diamonds are not only a symbol of the highest exclusivity, but also a first-class choice for long-term investments. The flawless clarity and perfect color quality make these diamonds a solid store of value that will endure in times of economic uncertainty and market volatility.

For colored gemstones:

Our colored gemstones such as rubies, emeralds and sapphires are hand-picked and of the highest quality. These gemstones are selected according to strict criteria to ensure that they have the best color intensities, clarities and cuts for the value size available. Rubies with their deep red, sapphires in intense blue tones and emeralds with their bright green not only offer aesthetic appeal but also an excellent way to diversify your investment portfolio. Due to their rarity and constant demand, these colored gemstones are stable and value-adding investments. Historically, high-quality colored gemstones have maintained and even increased their value over generations, making them an attractive option for investors seeking long-term security and growth.

Our gemstones not only offer a solid and stable investment for the present, but also a legacy of lasting value that you can secure and pass on for generations. Trust in our expertise and the quality of our certified gemstones to ensure the security and long-term success of your assets.